The most money and lowest monthly payment for your renovation

Borrow up to 90% of your future home value with a RenoFi Renovation Loan

WHAT IS YOUR PROJECT?

Accessory Dwelling Units (ADUs) have emerged as a popular choice, offering immense potential in this regard. Also known as an in-law or mother-in-law unit, secondary dwelling unit, granny flat or backyard apartment, ADU’s are on the rise. There has been a significant increase in demand for ways to finance their construction in recent years, especially since changes to California law mean that it is now easier than ever to build one in a single-family zone.

In fact, municipalities across the US have relaxed previous restrictions on ADUs, and a number of states are now actively encouraging their development.

Los Angeles’ Mayor Eric Garcetti has even claimed that ADUs are a “way for homeowners to play a big part in expanding our city’s housing stock and make some extra money while they’re at it.”

But one of the most common obstacles that people face when planning this addition to their homes is financing the construction, especially given that the average cost of an ADU can come in anywhere between $100,000 and $300,000.

Alongside this is the fact that there is often a gap between the cost of the construction and a homeowner’s borrowing power when using traditional mortgage products, adding further complexities.

Finding the right way to finance a dwelling unit can be confusing, but it doesn’t need to be that way. Having access to the right type of financing could mean that you are able to design and build with a higher budget, especially when you consider the rental income it could bring in.

The success of your ADU project hinges on securing the right ADU loan and financing. In this comprehensive guide, we’ll explore the critical aspects of ADU loans and financing, tailored to empower you with the knowledge needed to make savvy choices.

Before you embark on your ADU journey, it’s essential to comprehend the prerequisites for securing an ADU loan.

Understanding ADU Loan Requirements

Before you embark on your ADU journey, it’s essential to comprehend the prerequisites for securing an ADU loan. These requirements can vary depending on the lender and your location. Typically, they encompass factors like your credit score, income, and the feasibility of your ADU project. Lenders want to ensure that you have the financial capacity to undertake the construction or renovation.

ADU Requirements in California and Texas

ADU financing options can vary by state, with California and Texas serving as prime examples. In California, where ADUs are highly sought after, some municipalities offer incentives and financing programs to encourage construction. Conversely, in Texas, ADU financing options may differ, necessitating a detailed exploration of local programs and consultation with lenders well-versed in state regulations.

Expert Tip: Is an ADU a Sound Investment? Investing in an ADU can be a lucrative move, but its profitability depends on various factors such as location, demand, and your ability to manage the unit effectively. Conduct a thorough cost-benefit analysis to determine whether an ADU aligns with your financial goals

ADU Loans: Interest Rates, Financing, and Expert Advice

Despite its initial emergence dating back to the early settlers, Accessory Dwelling Units (ADUs) have truly had a second coming as a popular trend for homeowners, offering immense potential for additional income or housing. Regardless of its physical form (e.g., basement apartment, carriage house, etc.), these additional living spaces are part of the same property as the primary residence, consisting of one or two bedrooms, a kitchen, and bathroom. They can be used in several ways — from housing aging family members, accommodating visitors, earning rental income, and more.

There has been a significant increase in demand for ways to finance their construction in recent years, especially after changes to California law have now made it easier than ever to build one in a single-family zone. In fact, municipalities across the US have relaxed previous restrictions on ADUs, and a number of states are now actively encouraging their development.

But one of the most common obstacles that people face when planning this addition to their homes is financing the construction — especially given that the average cost of an ADU can land anywhere between $100,000 and $300,000.

Even further, there’s often a gap between the cost of the construction and a homeowner’s borrowing power when using traditional mortgage products, making things even more complicated.

Finding the right way to finance an ADU can be confusing, but it doesn’t need to be. Having access to the right type of financing will allow you to design and build with a higher budget — especially when you consider the rental income it could bring in.

The success of your ADU project hinges on securing the right ADU loan and financing. So let’s explore the critical aspects of how to finance an ADU, tailored to empower you with the knowledge needed to make smart choices.

Understanding ADU Loan Interest Rates

Like with any renovation loan, there are several factors that affect your ADU loan interest rates, including:

Credit Score: Lenders will assess your credit score and credit history to determine how reliable you’ll be paying off your loan. The higher your score, the lower your rates and vice versa — typically 670 or higher is good. If your score is on the low side, check for errors on your credit report, make sure you pay your bills on time, look to apply for a new credit, and consider getting an account (like a secured credit card) that could help you build a stronger credit history,

Loan Term & Type: Depending on the terms of your loan, you could have a fixed-rate or adjustable-rate loan structure, which will directly impact your rates over the life of your loan. A fixed-rate will be locked in regardless of market changes, while a variable rate will fluctuate, meaning you could end up paying more than you expected. Secured and unsecured loans will also differ in interest rates due to the level of risk involved with each.

Market Conditions: The economic factors will also impact those rates from the get-go. Some housing markets will have higher rates than others, while times of inflation or recession-like conditions will impact rates as well. Lower demand tends to result in higher rates. Explain how market conditions and economic factors can influence interest rates. Make sure you’re monitoring interest rate trends consistently leading up to your project.

Lender Policies: Different lenders will also offer varying interest rates based on their own policies and risk assessment. Make sure you shop around for different lenders to see how they compare.

Understanding Your ADU Loan Financing Options

The traditional options that are available to you for financing an ADU are typically based upon the amount of equity that you have available in your home, your household income, savings, and creditworthiness.

Alternatives do exist, however, that will let you borrow based on the future value of your home.

But one of the challenges often faced is the cost of construction and other associated fees, given that an ADU is so much more than a simple home renovation project. And for this reason, relying on equity or savings to cover these costs may result in the aforementioned gap between the budget you have available and the budget that you need.

That said, it’s important to also consider that one of the main differences between ADUs and other renovation projects is the rental income that they can bring.

Even when a dwelling unit is constructed in its entirety with borrowed funds, it can generate a positive return through rentals and increased property value in the future.

So let’s take a look at the financing options for dwelling units that are available to homeowners:

A RenoFi Loan

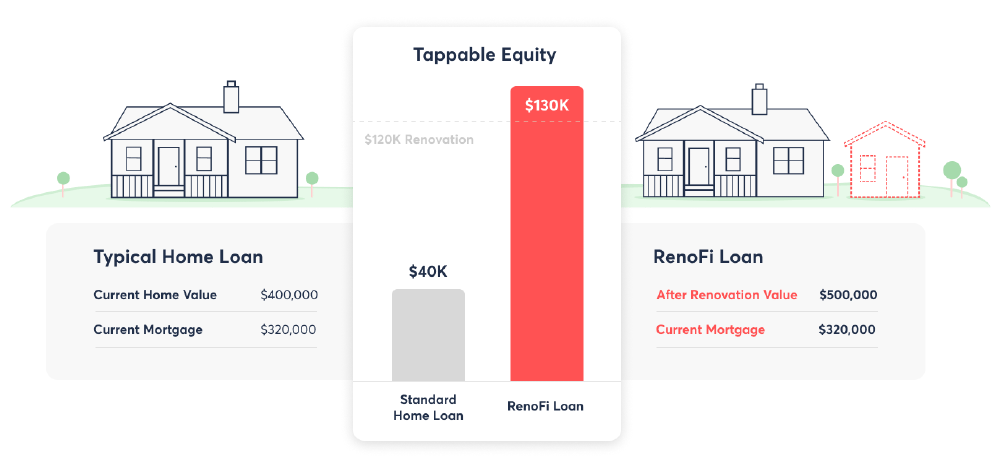

A RenoFi Loan is perfect for financing an ADU, given that it factors in what your home will be worth after construction is complete.

This, in turn, means that you can borrow all of the money you need at the lowest rate possible, overcoming the gap between borrowing power and available equity that many homeowners face.

A RenoFi Home Equity Loan gives the peace of mind of a fixed rate without the need to refinance your first mortgage, while a RenoFi Home Equity Line of Credit gives additional flexibility to draw what you need when you need it.

And RenoFi’s newest option - the RenoFi Cash-out Refinance - allows you to draw money from the equity of your new ADU to build it, while refinancing your primary mortgage.

The ability to borrow based on the value of your home after the addition of your ADU means that you can borrow more than what would be possible with other types of financing, even if you haven’t built up equity.

RenoFi Co-Founder and CEO Justin Goldman comments on this issue, stating: “Simply put, recent homebuyers are stuck between a rock and a hard place as it can take a decade or more to build up the equity needed to tackle their renovation wishlist.

“So what do homeowners do? 87% of them use cash - borrowing from retirement accounts, draining emergency savings, or borrowing from friends and family. Others rack up high-interest debt with personal loans and/or credit cards. And far too many begrudgingly reduce the scope of their project, tackling their renovation wishlist piecemeal over many years while living in a never-ending construction zone.”

Your house will go up in value with the addition of an ADU, and a RenoFi Loan can help you access this increase upfront to fund the construction.

A RenoFi Loan can often increase a homeowner’s borrowing power by 3x or more, while also ensuring the lowest possible rate.

Traditional HELOC (Home Equity Line of Credit) & Home Equity Loan

Financing the construction of an ADU using home equity is common. But if a homeowner doesn’t have sufficient equity to borrow against, this can present a problem.

Home Equity Loan

Home equity loans (also known as second mortgages) allow you to borrow a fixed amount of cash, backed by the equity that you have in your home, and repay it against an agreed upon schedule.

It is important to note that the interest rate payable on an equity loan will be higher than the rate on your first mortgage and will incur closing costs and other fees to cover an appraisal, lender fees, credit reports, etc.

HELOC

A HELOC (Home Equity Line of Credit) also allows you to borrow against the equity in your home and can provide a revolving line of credit (up to a set limit). In this case, interest is only payable (typically over a period of up to 10 years) on the cash that you have drawn on.

The interest rate incurred with a HELOC will be higher than on your first mortgage and is also likely to be a variable rate. The majority of lenders are willing to lend up to a maximum of between 80% and 85% of the value of your home (minus your first mortgage).

If you have recently purchased your home and have not built up much equity, either of these options will likely prevent you from borrowing the amount that you need for the construction of an ADU, creating a gap between your borrowing power and the cost of development.

Cash-Out Refinance

A cash-out refinance requires you to refinance your first mortgage and release some of the equity that has been built up in your home to finance the construction of your ADU.

While this option will consolidate the finance needed for construction and your first mortgage into a single loan, it again requires you to have built-up equity in your home. You will have much less borrowing power than with other options, with most cash-out refinances only letting you tap up to 80% of your home’s current value (unless you’re using a RenoFi Cash-out Refinance).

You’ll also face closing costs and higher rates than other financing options, essentially meaning that you’re throwing money away unless you’re significantly lowering your rate.

While someone who bought their home when interest rates were much higher (say in 2000) may find that this is a good move, some homeowners shouldn’t use cash-out refinance for renovations (including for the addition of ADUs).

A Construction Loan

Many people are wrongly steered in the direction of a construction loan for all kinds of home improvement projects, including the building of an ADU, for the simple reason that they help you to borrow based on the future value of your home.

And while a few years ago this might have been your best option for financing an ADU, this isn’t necessarily the case anymore.

In fact, we’ve written extensively about why you shouldn’t use a construction loan for your renovation.

While a construction loan may help homeowners who have less equity in their property to borrow the money they need to develop an ADU, they will need to refinance, and this can mean losing a great fixed rate (if this was locked in when these were at a rock-bottom low.

Construction loans will also face higher closing costs, based on the new value of the mortgage and budget, as well as adding a whole heap of additional work for both yourself and your contractor.

You see, construction loans were originally intended as a way to finance a new home build from the ground up, and stringent requirements were put in place by lenders as a method of protection.

As a result, this adds an extra layer of complexity to borrowing, such as your contractor being required to submit a draw schedule, arranging and waiting on inspections and a necessity to share continual updates with the lender.

Construction loans are a one-size-fits-all solution and are not based on your specific needs and requirements, meaning that there are likely better options to help you pay for building an ADU.

Unsecured Personal Loans or Credit Card

Personal loans and credit cards are categorically not the most suitable approach to financing an ADU. These methods are unsecured, so will have very high interest rates. Yet homeowners often use this type of finance to pay for renovation work to help plug the gap between their borrowing power and the equity that they can release — or simply because they assume that there are no alternatives.

You need a good credit score and a sizable household income to borrow on an unsecured personal loan or credit card, but in all honesty, we still believe this type of high-interest rate borrowing is one of the dumbest things that homeowners do when paying for renovations and additions to their property.

Steps to Securing an ADU Loan

ADU financing options can vary by state, with California and Texas serving as prime examples. In California, where ADUs are in popular demand, some municipalities offer incentives and financing programs to encourage construction. Conversely, in Texas, ADU financing options may differ, which means you should explore all the local programs and consult with lenders who are well-versed in state regulations.

Regardless of where you’re located, there are a few common steps to securing your ADU loan.

Determine your loan amount. First things first, figure out your budget. Talk to your financial advisor about your financial goals to help you understand how much you can afford. Figure out how much you’ll need your loan to cover, and then get about 3-4 estimates from contractors in your area based on your ADU wish-list. This information will help you figure out how much you need to borrow.

Assess your eligibility. There are a number of mortgage calculators out there that can help you better understand what you’ll qualify for — including RenoFi’s Loan Calculator. It will require information like your Debt-to-Income (DTI) ratio, FICO score, annual income, property type/location, etc. and will help you get a ballpark of how much you’ll be able to borrow. And check out the RenoFi Self Pre-Qualification tool to see if a RenoFi loan is a fit for you!

Research lenders. Get referrals from friends and family of reputable lenders in your area. Do your research and see which offers what types of loans, rates, and any discounts or programs that can get you the most for your project, while saving you on the cost of your loan. RenoFi has a whole network of great Credit Unions that we can connect you to in order to get the very best rates for your ADU loan.

Gather your documentation. Similar to #2 on this list, your lender is going to need to see proof of all the information to determine your eligibility. Here’s what you’ll need:

- 2 Most Recent Pay Stubs

- 2 Years of W-2 Forms

- Proof of Homeowners Insurance

- Most Recent Mortgage Statement

- Statements for Personal Bank, Retirement, and Investment Accounts

- Contractor Information

- Detailed Cost Estimate for Appraisal

- Renovation Plans (blueprints, drawings, contracts, etc.)

Apply for the loan. Once you have all your information and decided which loan you want to finance your project, you’re ready to apply! Fill out an application and submit it to your lender. Most lenders will have an application fee, and you may be asked different questions to verify your information before signing.

Other Things to Consider

We can’t emphasize this enough — the potential return on investment (ROI) when building an ADU is definitely worth the effort. Under the right circumstances, these additional dwelling units are a fantastic way to increase the value of your property and/or conveniently bring in another source of income without investing in a whole new property.

While not every city sees the same level of real estate benefit, in more populated cities or states like California where ADUs are in high demand, the average home listed with an ADU is priced 35% higher compared to similar homes in the area. And depending on rental income and project costs, you could bring in an ROI of 5-10%.

As you make the decision of whether or not it’s the right move for you and how to finance your ADU if it is, here are some final things to consider.

- What permits do I need? Every city and state will differ, so you’ll need to visit your local government website and find out which building permits, land use permits, special event permits, temporary use permits, and business-related permits may be required. Your contractor will likely be able to help you obtain them, but you’ll have to pay for them.

- Do I need an architect? Some states may require an ADU architect under certain circumstances. For example, in CA, you’ll need a licensed architect to put a stamp on your plans only if the structure is more than two stories high. If you’re not sure, consult with local contractors or check out your local government websites.

- Am I following local building codes? Look into your city/states’ local zoning laws to make sure everything will be up to code. Each area will have its own rules as to the size of the ADU in regard to lot size, as well as how tall or far from the main property certain units have to be.

Financing Shouldn’t Be the Hardest Part of Building an ADU… RenoFi Can Help

Building an ADU should be an exciting endeavor, giving you the opportunity to bring in another source of income or increase the functionality and value to your home. But the unfortunate reality for many homeowners is knowing how to finance an ADU in the smartest way possible typically adds another layer of complexity to the process.

But RenoFi can help. We know the best way to finance an ADU is a RenoFi Renovation Home Equity Loan, since it factors in the value of your property after theADU is built, greatly increasing your borrowing power. And if you need guidance along the way, our Renovation Advisors are here for you. We can connect you with the best Credit Unions in your area, which can offer you even lower rates than traditional banks. And our network of trusted contractors can also give you a major jump start on your selection process. Contact us today to learn more.

It’s Time to Feel Inspired

Knowing that you’ve found the perfect solution for financing an ADU is a huge weight off your shoulders.

In fact, securing the funds to start construction means you can start to have conversations with contractors and architects who can realize your vision.

But it always pays to dream big and take the time to inspire and immerse yourself in the projects other people have shared for the rest of the world to see.

And to help get you thinking about what could be possible, we love Houzz’s outbuildings ideabook and ADU ideas & photos collection, as well as Pinterest (of course!) and Dwell’s round up of 29 Granny Flats That Put Guests Up in Style.”

FAQs on Financing an ADU

Is adding an ADU a good investment?

Does an ADU add value to your home?

What is the best way to finance an ADU?

What financing options exist to build an ADU?

Financing Shouldn’t Be the Hardest Part of Building an ADU … RenoFi Can Help

The prospect of building an ADU should be an exciting one, but the unfortunate reality for many is that financing typically adds another layer of complexity to the process.

But RenoFi can help.

The most money and lowest monthly payment for your renovation

Borrow up to 90% of your future home value with a RenoFi Renovation Loan

WHAT IS YOUR PROJECT?